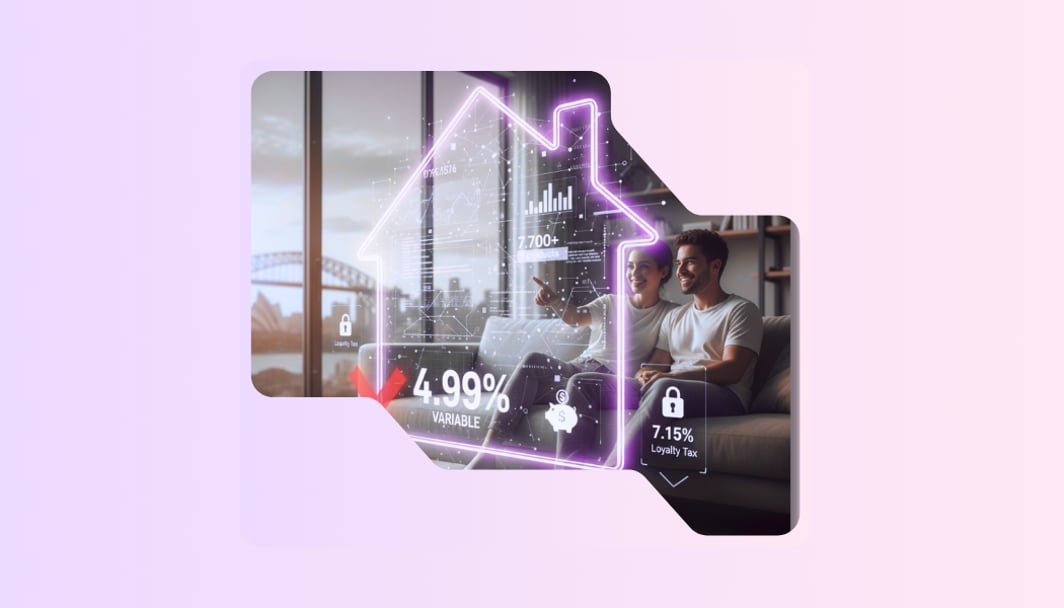

Variable rates from 4.99%. Fixed rates from 5.09%.

But if you're paying above 7%, you're losing $40,000+ to the "Loyalty Tax."

In 2026, the best mortgage rates aren't on the first page of traditional comparison sites; they're buried in 7,700+ products that require real analysis, not just a list. Here's how AI-powered home loan comparison is beating the banks at their own game.

Compare Mortgage Rates: The 2026 Reality Check

Most Australians searching for "compare home loans" see the same recycled results: banks offering 4.99% variable rates with $2,000 cashback and 1-2-year fixed terms at around 5.09%. Meanwhile, 3.2 million borrowers are stuck on revert rates above 7%, a silent tax on customer loyalty.

Between RBA cash rate movements, confusing government schemes, and lenders who change their offers weekly, finding the best home loan in 2026 shouldn't require a finance degree.

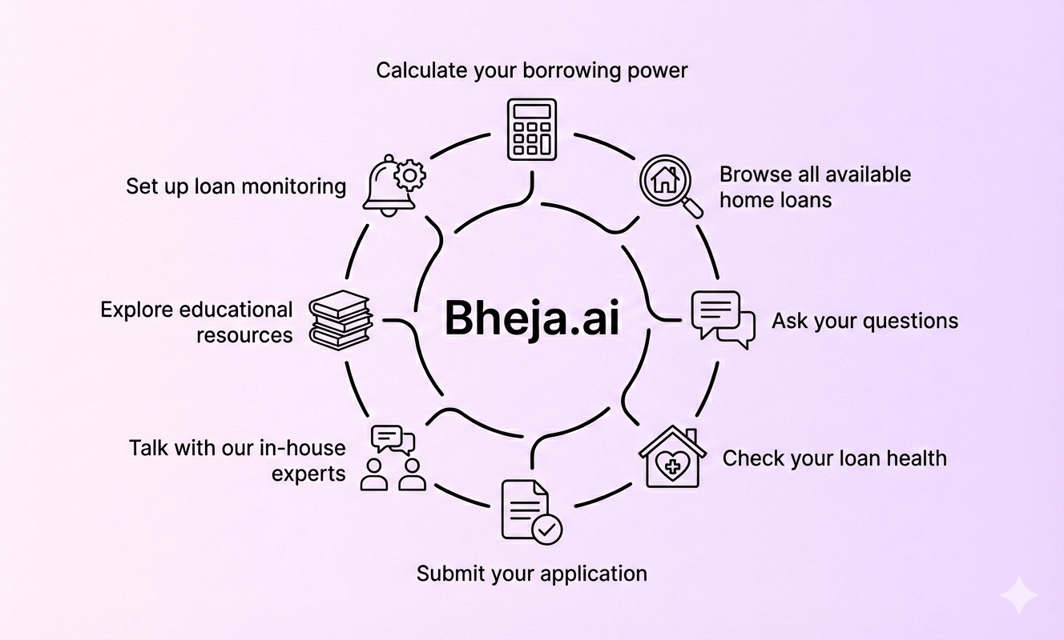

At Bheja.ai, we've built three core pillars to help you stop searching and start saving.

3 Core Tools That Solve Every Mortgage Challenge in 2026

1. The "Refinance Health Check": Is Your Current Loan Costing You?

The Problem: Most Australians searching "compare home loans" see the same recycled results. But if you've been with your bank for more than two years, you're likely paying a Loyalty Tax a rate significantly higher than what new customers get.

When you search "best refinance rates Australia," you'll see:

- Variable rates: 4.99% - 5.49%

- Fixed 1-year: 5.09% - 5.39%

- Fixed 2-year: 5.19% - 5.59%

But traditional comparison sites don't tell you if switching is actually worth it after fees.

The Tool: Refinance Health Check Calculator

What it does: It doesn't just show you a list of rates. It performs a deep audit of your current loan against 7,700+ products in real-time.

The Result: It calculates your Net Benefit, factoring in discharge fees ($395), application costs ($700), and valuation fees ($200)—to tell you exactly how many thousands of dollars you'll save over 5 years by switching.

Real Example:

- Current loan: $650,000 at 7.2% (typical revert rate)

- Best refinance option: 5.15% variable with offset

- Switching costs: $1,295

- Net savings: $50,820 over 5 years ($847/month lower repayments)

Not just a rate comparison. A complete financial audit.

2. First Home Buyers: Know Your True Budget

The Problem: The biggest hurdle for first home buyers in 2026 isn't just finding a house; it's knowing exactly what the bank will let you borrow when you factor in government grants and schemes.

Questions first home buyers actually search:

- "How much can I borrow for a home loan?"

- "First home buyer calculator with Help to Buy"

- "5% deposit home loan eligibility"

- "Borrowing capacity calculator Australia"

The Tool: Borrowing Power Calculator

What it does: Most bank calculators are too simple; they use generic expense assumptions and ignore government schemes entirely. Our calculator factors in:

- Your specific income and living expenses

- Eligibility for Help to Buy (up to 40% equity contribution)

- Eligibility for the 5% Deposit Scheme (avoid LMI on loans up to $1M)

- HECS debt, credit cards, and other commitments

- Different lender serviceability criteria (some lenders are 20% more generous)

The Result: You get a realistic maximum purchase price, so you can attend auctions with the confidence of a tech-backed buyer—not waste time on properties you can't afford or miss out on ones you can.

Real Example:

- Income: $85,000 single parent in Sydney

- Deposit: $30,000

- Standard calculator: "You can borrow $425,000"

- Bheja.ai with Help to Buy: "You can purchase up to $710,000" (government contributes 40% equity = $284,000)

That's the difference between a 1-bedroom apartment and a 3-bedroom house.

3. For Every Other Scenario: Just "Ask Bheja"

The Problem: Mortgages aren't static. Life changes, rates go up, you get a promotion, or you want to renovate. For complex "What If" scenarios, you don't need a spreadsheet; you just need to ask.

The Tool: Ask Bheja (Conversational AI)

What it does: Think of it as your 24/7 digital mortgage broker. You can ask in plain English:

"How will a 0.25% rate hike affect my monthly repayments?"

"What happens if I put an extra $500 into my offset every month?"

"Should I fix 50% of my loan at 5.09% or stay fully variable?"

The Result: Instant, data-backed strategy and repayment projections that allow you to plan your financial future in real-time.

This is a strategy, not just a calculation. It's what a senior mortgage broker would tell you instantly, 24/7, for free.

Best Home Loan Rates Australia 2026: What to Actually Look For

When you compare mortgage rates, don't just look at the headline number. Look at:

✅ Comparison rate (includes fees, the real cost)

✅ Offset account availability and functionality

✅ Redraw facility terms (some banks restrict this heavily)

✅ Break fees for fixed loans (can be $10,000+)

✅ Application and ongoing fees (some "low rate" loans have $395/year fees)

✅ Cashback conditions (many require you to stay 3+ years or they claw it back)

2026 Benchmark Rates (as of February 2026):

- Best variable rate: 4.99% (comparison rate ~5.15%)

- Best 1-year fixed: 5.09% (comparison rate ~5.25%)

- Best 2-year fixed: 5.19% (comparison rate ~5.35%)

- Average revert rate: 7.15% ⚠️

If you're above 5.5% on a variable loan, you're almost certainly paying too much.

How Bheja.ai Works: Stop Searching, Start Asking

- Login (your data is encrypted and never sold to third parties)

- Choose Your Tool:

- Refinance Health Check (existing borrowers)

- Borrowing Power Calculator (first home buyers)

- Ask Bheja (complex scenarios)

- Get Your Strategy: Not just numbers, but actionable next steps

- Connect with Brokers (optional): If you want human support, we connect you with licensed specialists

Built by tech veterans and licensed Australian mortgage brokers, we provide the tools that the Big Four banks don't want you to have.

The Bottom Line: Stop Searching. Start Auditing.

You deserve a tool that actually works for you.

Bheja.ai is free to use. No sales pressure. No hidden fees. Just honest analysis powered by AI that's actually smart enough to read the fine print and calculate what matters: your real savings.

Common Searches We Answer:

- Compare home loan rates Australia 2026

- Best mortgage refinance calculator with fees

- First home buyer borrowing capacity calculator

- Help to Buy scheme eligibility and calculator

- Mortgage repayment calculator with offset account

- Should I fix my home loan or stay variable?

- How much can I borrow for a house in Australia?

- Best variable rate home loans 2026

- Refinance home loan comparison

- 5% deposit home loan lenders